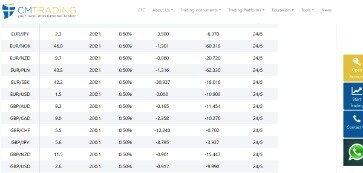

TOP 10 Currency Pairs for Carry Trade Forex Sentiment Board

Contents:

Money can now be moved from one country to another at the click of a mouse, and big investors are not hesitant to move around their money in search of not only high but also increased yield. The attractiveness of the carry trade is not only in the yield but also the capital appreciation. When a central bank is raising interest rates, the world notices and there are typically many people piling into the same carry trade, pushing the value of the currency pair higher in the process.

- FX trading can yield high profits but is also a very risky endeavor.

- Those who insist on fading AUD/USD strength, for example, should be wary of holding short positions for too long because more interest will need to be paid with each passing day.

- A carry trade is more potent if the asset currency is trending upwards.

- But did you notice that we said that FX carry trading isn’t dead?

A carry trade involves borrowing from a lower interest rate asset, which is usually a currency pair, to fund the purchase of a higher interest rate asset. Investors execute an FX carry trade by borrowing the funding currency and taking short positions in the asset currencies. The central banks of the funding currencies usually what are the 7 major currency pairs use monetary policies to lower interest rates in order to facilitate growth during times of recession. As the rates fall, investors borrow money and invest them by taking short positions. When it comes to currency trading, a carry trade is one where a trader borrows one currency , using it to buy another currency .

What is a carry trade?

Practice different trading techniques, and apply your trading strategies. A type of momentum indicator, oscillators are used by traders when they cannot identify a clear trend in specific stock prices. Oscillators measure momentum, typically fluctuating between two bands , indicating whether an asset has been overbought or oversold. There are certain fundamentals a day trader must know in their attempt to make a profit from trading forex. For higher probability trades, traders should look for entry points in the direction of an uptrend and should protect downside risk by utilizing prudent risk management techniques.

Carry trading can return regular profits when markets stay relatively stable, which makes it a popular strategy during times of low volatility. However, as with any forex trade comprehensive risk management is essential—so make sure you have your stop-loss and take-profit orders set up before entering the position. Two popular secondary currencies for positive carry trades are the Japanese yen and the Swiss franc . Traders have more options when it comes to high-yield base currencies.

As such, we maintain a defensive tilt in our model portfolio, and further increase our UW in equities vs. raising our cash allocation this month. Yields came down sharply off recent highs in the wake of last week’s market distress, so we wait for a better entry point to add to duration. He opens up a real account, deposits his $10,000 birthday gift, and puts his plan into action. Joe, being the smart guy he is, has been studying BabyPips.com’s School of Pipsology and knows of a better way to invest his money. You pay interest on the currency position you SELL and collect interest on the currency position you BUY.

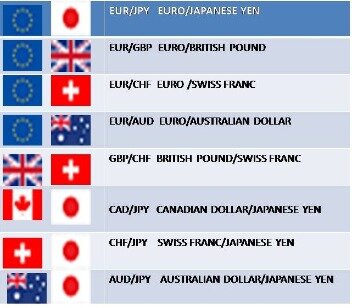

One has to look for appropriate currencies like the New Zealand dollar/Japanese yen or the Australian dollar/Japanese yen for carrying trading. A positive swap is credited every day, a negative swap is deducted. The risk is offset by constant monitoring offundamental factorsthat affect the discount rate. Carry Trade can also mean borrowing in a low-interest rate currency, converting it to a high-interest-rate currency, and buying the highest rated bonds .

Advantages and Disadvantages of Forex Carry Trade Strategy

This means you only need a small deposit to control a large amount. You can learn more about the risks involved in trading on margin in the ‘ What is Leverage in Forex Trading? Most Forex brokers will also charge their clients more to trade exotic currency pairs.

Interest rates can be changed at any time so forex traders should stay on top of these rates by visiting the websites of their respectivecentral banks. FX carry trade stands as one of the most popular trading strategies in the foreign exchange market. Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors.

This lesson will explain FX carry trades further through examples. We’ll also explore popular carry trade strategies and how you can try to incorporate them into your trading plan. Investments involve risks and are not suitable for all investors.

When the economy is slowing down and financing costs are rising, all these implicit or explicit carry trades are pressured to unwind, leading to an end of the cycle. We believe we are in that stage and remain negative on risky asset classes. The amount of profit of a positive swap does not depend on the dynamics of the trend, only its direction is important. But if you have already caught an uptrend, the best option is to get as much profit as possible from it by closing the position at the time of the reversal.

For the better part of the last 10 years, the carry trade was a one-way trade that headed north with no major retracements. However, in 2008, carry traders learned that gravity always regains control as the trade collapsed, erasing seven years worth of gains in three months. First, the trader will borrow yen and convert it into dollars. Let’s say that the rate is 110 yen for every one U.S. dollar, and the trader borrows 25 million yen. We want to calculate how many U.S. dollars they will have after they convert the funds.

Traders then accrue big profits, because they are receiving interest on their U.S.-based assets. They can make even larger profits if the dollar rises against the Yen, or if the U.S. A carry trade is more potent if the asset currency is trending upwards. Start executing trades in a simulated trading environment using virtual money.

What Is Carry Trade?

However, this is also a con of the carry trade in Forex as using leverage can also mean bigger losses. If the trader went long on EUR/CAD they would be paying 11.87 EUR each night for the position resulting in a negative carry. But if the exchange rate appreciated, the profit from the trade may offset any accumulated overnight swap fees. However please notice, that past performance is not necessarily an indication of future performance. One of the biggest reasons the Forex market is popular for carry trade strategy trading is the fact you can trade on margin.

Momentum indicators are used to measure the strength or weakness of stock prices over a specified period. They calculate the rate of change of prices rather than actual price changes. This style of trading monitors broader global events or economic news and then looks to identify trading opportunities from the volatility that these bring.

Ideally at the very least, they’d be providing forward guidance on policy that suggests rates will likely be rising in the near to medium term. The calculator would give you the interest rate which you’ll pay or will be paid with your trading positions. The interest rate is calculated with the duration and the size of your position. Timothy Li is a consultant, accountant, and finance manager with an MBA from USC and over 15 years of corporate finance experience.

Risks and Limitations of Carry Trades

This condition will not guarantee a positive swap, but will speed up finding the right pair. For a short position, the condition is reversed – the discount rate for the quoted currency must be higher. Private traders who try to avoid risks operate with amounts up to 1,000 USD. Based on the risk, it is possible to calculate the allowable volume per trade, and hence the point value. This profit, taking into account the risk and the time spent, is rarely worth it. If it grows, the investor gets a profit in addition to the difference in discount rates.

Have also become a popular way for traders to broaden their knowledge. Research is key however to ensure you’re acquiring accurate information. Affordable webinars and online forex trading courses are also easily accessible, allowing you to grow your trading expertise, no matter where you are in the world.

We also offer a range of trading guides to supplement your forex knowledge and strategy development. If you are just starting out on your forex trading journey, you can learn the basics with our free New to Forex guide. Auto loans, levered loans, credit cards all yield well while short-term funding is plentiful and consumers strong. Brokers close and reopen your position, and then they debit/credit you the overnight interest rate differential between the two currencies.

Large traders will borrow Yen at these very low interest rates, and then convert them to dollars. These dollars are then used to invest in Treasuries that provide a much higher yield than the interest charged on the borrowed Yen. In both versions, one thing remains constant – the main intention behind executing a forex carry trade strategy remains the same. That is, to profit from the difference between the two interest rates. Regardless, our analysis will mainly focus on the borrowing version of the forex carry trade strategy.

What is Swing Trading? The Best Strategies, Indicators and Signals to Trade for Beginners

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The lower yielding currency is called the “funding currency.” The trader then effectively “borrows” the low-yielding currency each day and effectively “lends” the high-yielding currency. There is no doubt that carry trading, while potentially lucrative, carries a fair amount of risk. This is because the best currencies for this type of trading tend to be some of the most volatile. Negative market sentiment among traders in the currency market can have a rapid and heavy effect on “carry pair” currencies.

Trading in CFDs carry a high level of risk thus may not be appropriate for all investors. After the 2008 financial crisis U.S. interest rates dropped enough that the so-called Yen carry trade was no longer profitable. However, the Yen remains at zero https://day-trading.info/ interest rates and it is possible to participate in a Yen carry trade by buying the Australian dollar or New Zealand dollar while selling Yen. Alongside a rate hiking cycle, currency carry trades are most effective during times of low volatility.